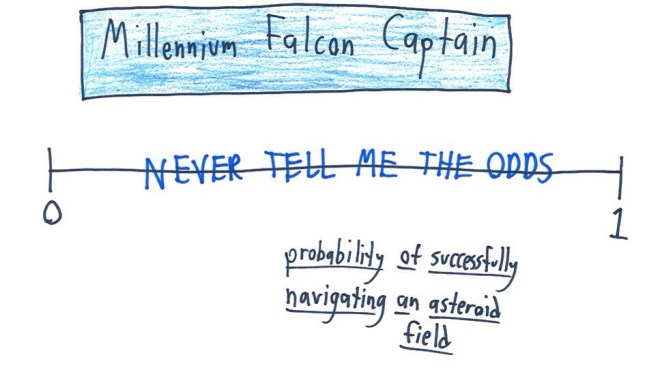

Prediction, like medicine in the early 20th century, is still mostly based on eminence rather than evidence. The most famous forecasters in the world are newspaper columnists and television pundits. Superforecasters make for bad media stars. Caution, nuance and healthy scepticism are less telegenic than big hair, a dazzling smile and simplistic, confident pronouncements. But even if the hoped-for revolution never arrives, the techniques and habits of mind set out in this book are a gift to anyone who has to think about what the future might bring. In other words, to everyone.

Author: Edouard Chazal

Apple Is Building Its Largest Startup Ever

Meanwhile in Cupertino, CA :

Apple’s ultimate success with Project Titan will depend not on whether Apple can build autonomous features into an automobile or come up with a breakthrough user interface. Rather, those features are byproducts of the much bigger product that Apple is trying to build: the best team of automotive experts in the world. Even though Apple prides itself on a culture that puts the product first, the biggest risk factor to Apple Car is corporate politics and too many layers of management and decision-making. Success will come from allowing ideas to grow from the design labs to showroom without having interference.

What Does Probability Mean in Your Profession?

Seven Reasons Volkswagen Is Worse Than Enron

The comparison is fair, Europe signed a blank cheque to an industry they rely on so heavily.

Though, I diverge from what is a rather alarming picture : VW will never be allowed to go down, at any cost for the German government.

The real issue may be that other car manufacturers are part of this scheme — among them the Daimler Group, which would add up quite a bit to the bill as it is another major German champion.

Second, led by Volkswagen, Europe’s car manufacturers lobbied hard for governments to promote the adoption of diesel engines as a way to reduce carbon emissions. Whereas diesel engines power fewer than 5 per cent of passenger cars in the US, where regulators uncovered the fraud, they constitute more than 50 per cent of the market in Europe thanks in large part to generous government incentives.

It was bad enough that Enron’s chief executive urged employees to buy the company’s stock. This, however, is the equivalent of the US government offering tax breaks at Enron’s behest to get half of US households to buy stock propped up by fraudulent accounting.

The End Of The Free Web

The rise of ad-blocking will force us to confront the fact that the free lunch provided by advertising is not long for this world. The good news is that the ensuing crisis will compel us finally to look for what we should have invented decades ago, namely sustainable business models for the web. For example, it’s possible that cryptocurrencies might enable the “micro-payments” that would make users to pay a tiny amount for any article they read. We need more ideas like that, and I’m sure we’ll get them. Necessity is the mother of invention.

What about a monthly subscription ?

Let’s say that for 10 bucks a month you’d get access to several websites without having to deal with specific subscriptions, just a single one : the service. The service would gets a cut for its own profitability, then split variable revenues accros the differents publishers affiliated based on the pageviews of the reader/subscriber.

If the reader only opens a link per month, the 10 bucks minus the service‘s cut goes to that single publisher, and so on.

This idea has already been put in place in a rather confidential way by Elinea, a Dutch company, and more recently by another one — though I can’t remember its name. Both are based on the all-you-can-read model.

This could possibly gain momentum if indie publications with strong names jump onboard. But as of now, I bet they’re reluctant to get rid of The Deck and native ads, which they seem fine with.

Last week, the content-blocker Crystal announced a partnership with Eyeo, a service that whitelist website using ads considered as acceptable. The promise is that Crystal will indeed show ads that have been approved by the members of the organization, based on several criterias.

From now on, I think this is a good trade of between cleaning big websites, which are imposing a shitload of ads (but also rely on subscriptions) and supporting indies (who don’t offer subscription for the most part). I encourage you to read more about Crystal’s initiative.