Op-Ed by Yanis Varoufakis :

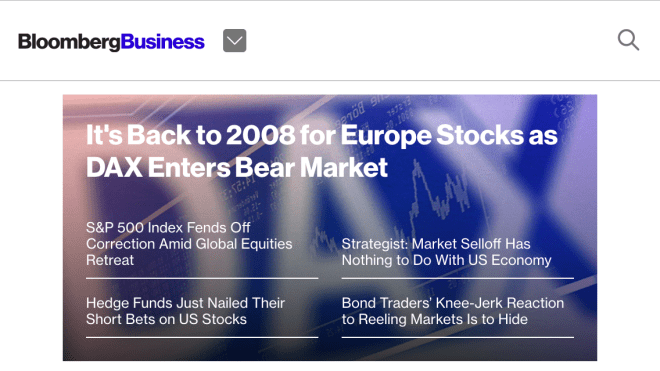

The fact that few people ever got to hear about the Greek plan is a testament to the eurozone’s deep failures of governance. If the “Athens Spring” — when the Greek people courageously rejected the catastrophic austerity conditions of the previous bailouts — has one lesson to teach, it is that Greece will recover only when the European Union makes the transition from “We the states” to “We the European people.”

Across the Continent, people are fed up with a monetary union that is inefficient because it is so profoundly undemocratic. This is why the battle for rescuing Greece has now turned into a battle for Europe’s integrity, soul, rationality and democracy. I plan to concentrate on helping set up a Pan-European political movement, inspired by the Athens Spring, that will work toward Europe’s democratization.

Credit: Death of Euros, Goin