Monday, August 24th brought you one of the weirdest trading day ever seen in the past several years.

So to sum up what happened today, here are a few charts, courtesy of Bloomberg, ZeroHedge and NANEX — time of the events may vary :

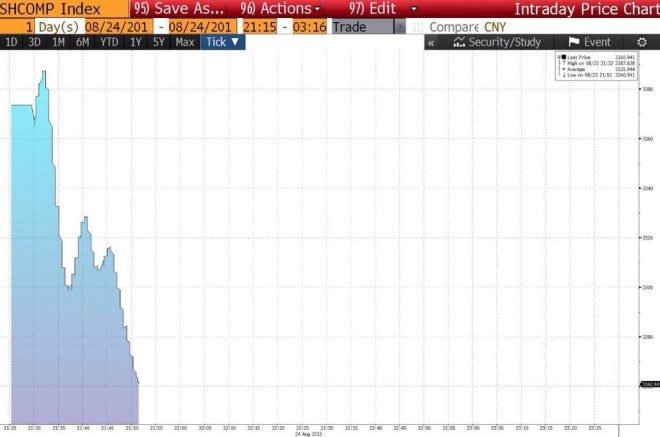

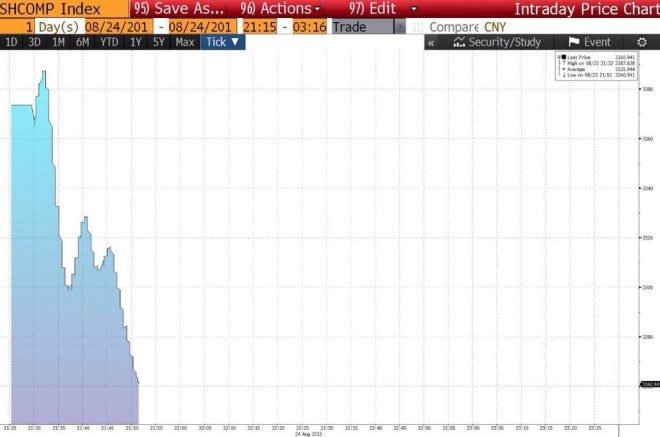

- It all started sometimes in China, when it’s business as usual these days :

- S&P Futures followed, kissing the dirt :

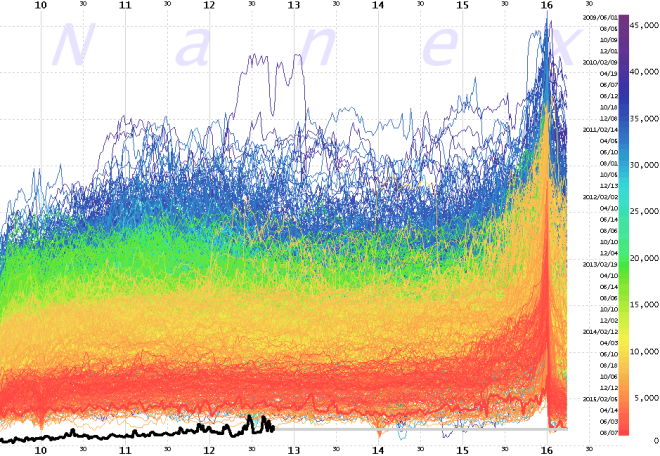

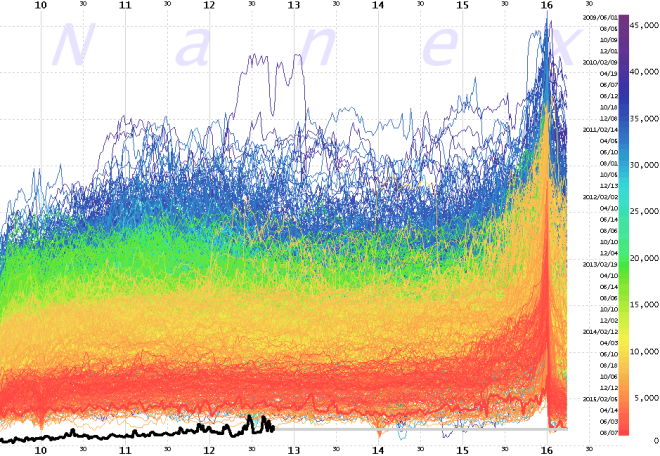

- Which then started a major liquidity squeeze on the US market, as seen on the following charts by NANEX :

- Causing buy-sell orders to never quiet match — courtesy of ZeroHedge :

- Shortly after the opening bell, something like this on the Dow Jones :

- And an impressive rise on the VIX :

- In the meantime, major (mini) crashes :

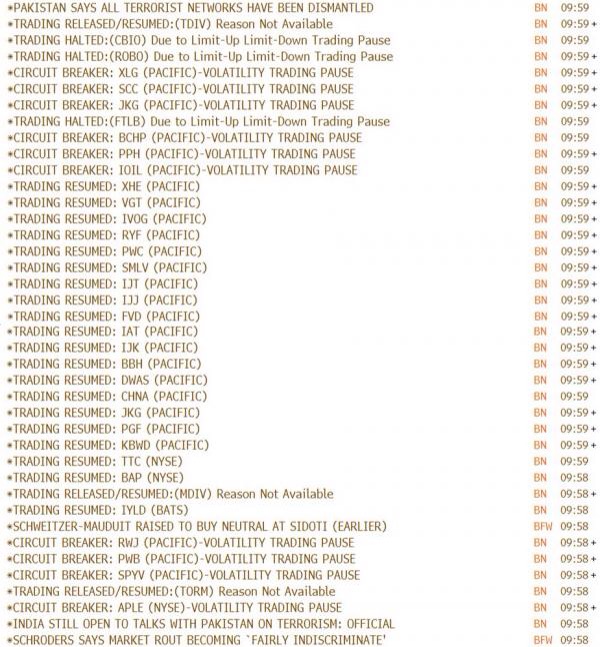

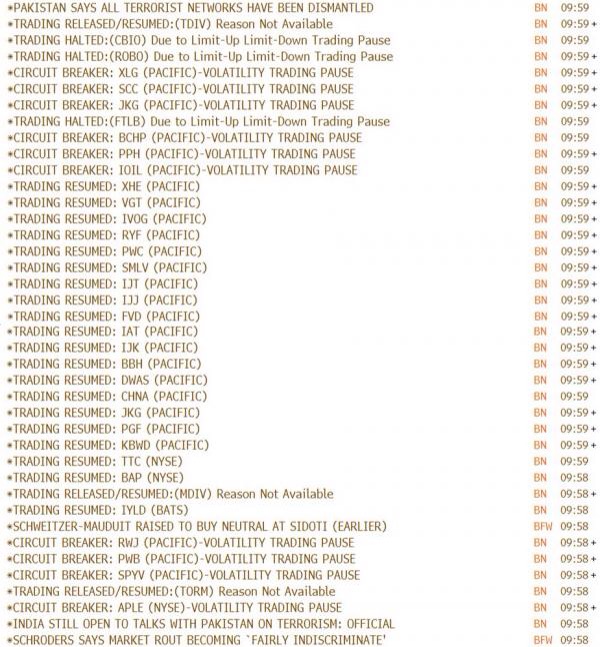

- To prevent further deterioration, just press the “HALT” button across major indices, including 3 consecutive press on the NASDAQ and 1’200 times during that day :

- Then the master of markets, Tim Cook, dropped an email to Jim Cramer stating the following :

I get updates on our performance in China every day, including this morning, and I can tell you that we have continued to experience strong growth for our business in China through July and August. Growth in iPhone activations has actually accelerated over the past few weeks, and we have had the best performance of the year for the App Store in China during the last 2 weeks.

- Then, all of a sudden, while unrelated from the previous event — well, who knows :

- …While European markets will stay stucked for a little longer :

There’s more to it for sure, but here are some events, mostly correlated, to show the newcomer what’s up for today on the trading side.

Finally here’s a fun tweet from Josh Brown :

@ReformedBroker: Look, it doesn’t matter what you bought or what you sold. The important thing is that you panicked.