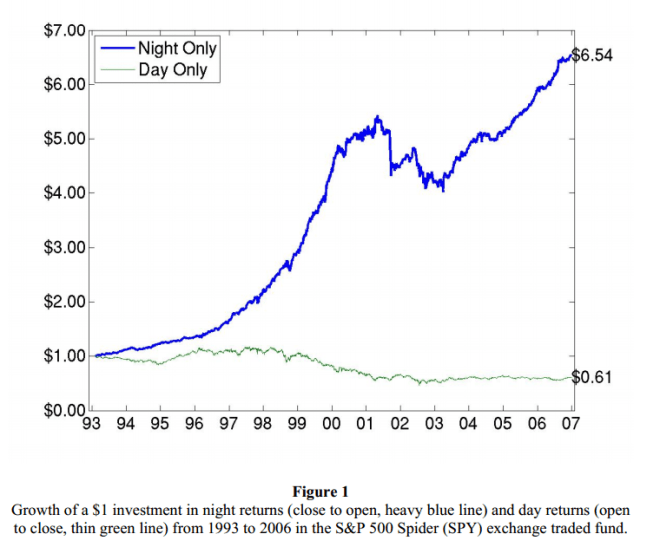

Panel A lists the close-to-close returns of the momentum strategy. As discussed above, close-to-close return equals the sum of the overnight return and the intraday return. Momentum seems to show up in close-to-close returns. Panel B shows the main result of this paper: Almost ALL of the abnormal returns in the momentum strategy are generated overnight, rather than intraday.

Category: Finance

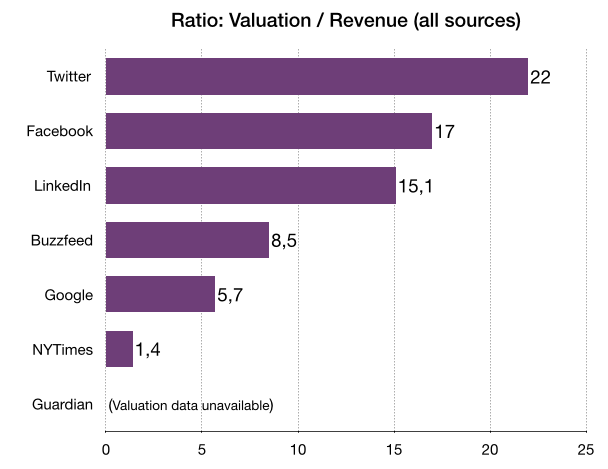

The NYTimes Could Be Worth $19bn Instead Of $2bn

Frédéric Filloux :

Through this lens, if Wall Street could assign to The New York Times the ratio Silicon Valley grants BuzzFeed (8.5 instead of a paltry 1.4), the Times would be worth about $19bn instead of the current $2.2bn.

Again, there is no doubt that Wall Street would respond enthusiastically to a major shrinkage of NYTCo’s print operations; but regardless of the drag caused by the newspaper itself, the valuation gap is absurdly wide when considering that 75% of BuzzFeed traffic is actually controlled by Facebook, certainly not the most reliably unselfish partner.

While BuzzFeed relies on ridiculous headlines and traffic from Facebook, investors are more inclined to value BuzzFeed way higher than the Times because of the potential it can generate in the future.

On the other hand, the Times is a safe-house, which proved to be realistic 5-7 years ago by transitioning into a successful digital brand. So all in all, the growth of Times is less tangible than a relatively new website. That’s precisely why there’s such a gap between the two. Though to be perfectly realistic, considering that one is kinda overvalued and the other one undervalued (in Silicon Valley standard) these two ratios should adjust and get closer together.

Why Are Commodity Prices Falling ?

In fact, there are four channels through which the real interest rate affects real commodity prices (aside from whatever effect it has via the level of economic activity).

First, high interest rates reduce the price of storable commodities by increasing the incentive for extraction today rather than tomorrow, thereby boosting the pace at which oil is pumped, gold is mined, or forests are logged.

Second, high rates also decrease firms’ desire to carry inventories (think of oil held in tanks).

Third, portfolio managers respond to a rise in interest rates by shifting out of commodity contracts (which are now an “asset class”) and into treasury bills.

Finally, high interest rates strengthen the domestic currency, thereby reducing the price of internationally traded commodities in domestic terms (even if the price has not fallen in foreign-currency terms).

Inside The Biggest-Ever Hedge-Fund Scandal

Hint : S.A.C.

The tactics echoed the approach the F.B.I. had used to dismantle the New York Mob. The plan was to arrest low-level soldiers, threaten them with lengthy jail terms, and then flip them, gathering information that could lead to arrests farther up the criminal hierarchy.

Over time, agents produced an organizational chart with names and faces, just as they had with La Cosa Nostra.

At the top of the pyramid was Steven Cohen.

It took me quite some time to read this gigantic piece, but as always, The New Yorker delivered a brilliant investigation. Here is another one from Vanity Fair.