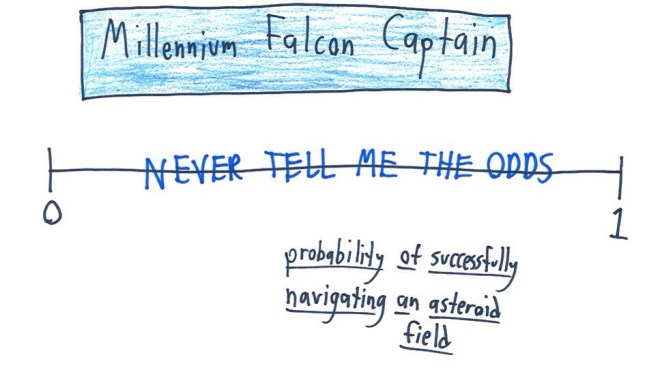

Prediction, like medicine in the early 20th century, is still mostly based on eminence rather than evidence. The most famous forecasters in the world are newspaper columnists and television pundits. Superforecasters make for bad media stars. Caution, nuance and healthy scepticism are less telegenic than big hair, a dazzling smile and simplistic, confident pronouncements. But even if the hoped-for revolution never arrives, the techniques and habits of mind set out in this book are a gift to anyone who has to think about what the future might bring. In other words, to everyone.

Category: Science

What Does Probability Mean in Your Profession?

All Credit To Them

On consumer lending :

The most creditworthy customers, it turns out, are the least keen to splurge when extra credit is offered. For every dollar their credit limits increase, they boost their borrowing by $0.23. Even that is an exaggeration: by further digging through the data, the researchers establish that the borrowers with the best credit records are only shifting their borrowing from card to card to take advantage of improved terms—not borrowing any more in aggregate. At the other end of the scale, those with the muckiest credit histories borrow an extra $0.58 for every $1 hike in their credit limit.

But that is not the whole story. The researchers then take a bank’s perspective, and ask to whom it makes most sense to lend. Boosting credit limits draws in extra interest payments and charges, but there are costs too. If it is mainly the highest-risk borrowers who take advantage of higher limits, or if the higher limits encourage more reckless borrowing in general, then default rates will climb, eating away at profit margins.

Is It Time To Get Serious About Electric Cars ?

Following VW’ scandal, here is Jean-Louis Gassée on a necessary transition :

Filling up the cars as described represents 1.3 terawatts pulsing through the grid to the electric filling stations. The Syracuse University page pegs the entire US electric supply at about 1 terawatt. Again, I’m not vouching for exact numbers, just the orders of magnitude. Now, add an uncomfortable twist to those numbers: Transmission loss in the electric grid is more than 7%; compare this to the less than .1% for the transportation and evaporation of gasoline.

The result is that we have more than just the science problem of replacing gasoline with electric energy storage. We also face an infrastructure challenge to, first, generate the electricity and, second, transport it to the filling stations at home or on roadsides. It will take a very long time, huge amounts of money, and interesting politics to solve these two problems. And, while I’m not a diehard GM fan, it should (but won’t) kill the “General Motors killed the electric car” myth.

Brad Katsuyama’s Next Chapter

In the summer of 2014, Puzz had another puzzle to solve. From March to July, the frequency with which an IEX customer could have gotten a better price less than 10 milliseconds after a trade posted rose from about 3 percent to as much as 10 percent. This wasn’t meant to happen. IEX was supposed to protect investors from what’s known as stale quote arbitrage; that’s when a high-frequency trader takes advantage of milliseconds-long delays in how markets update prices to reflect movements on other exchanges. These tiny delays allow high-speed traders to see a price fluctuation on one exchange and then quickly send an order to another market—often a dark pool—that it knows updates its prices more slowly, hoping to pick off the orders resting there at stale prices. It’s a bit like betting on yesterday’s horse race against someone who doesn’t know the result.

IEX prevents stale quote arbitrage with its “magic shoe box,” a metal container in its data center in Weehawken, New Jersey. Crammed into it are 38 miles (61 kilometers) of coiled fiber-optic wire, creating IEX’s speed bump of 350 microseconds (about one one-thousandth of the time it takes to blink). The idea of countering super-fast traders by creating a slower market might seem like a paradox. It’s not. IEX uses the same high-speed data feeds as HFT firms do to monitor other exchanges for price changes. But because IEX didn’t want to be in a technological arms race with the high-frequency traders to process this information faster than they do, it uses the speed bump to slow down all new orders—just enough to ensure IEX has time to update its prices to reflect any movements on public exchanges. This prevents orders on IEX from being traded against at stale prices.

So how, Aisen wondered, could HFT firms be picking off IEX orders despite the magic shoe box? It didn’t take Puzz long to solve the riddle. He discovered that some HFT algorithms could predict price changes—like surfers sitting out past the break, scanning the swell for their next ride—and target orders before the magic shoe box’s speed bump could protect them.