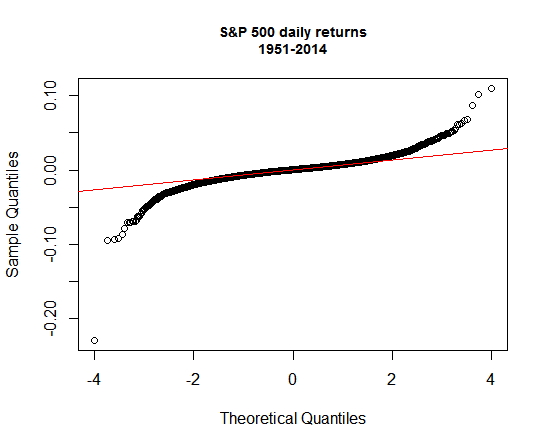

To illustrate the phenomenon, consider the S&P’s daily percentage returns in terms of quantiles, which divides the performance record into equal-sized portions. The graph below plots the sample return of the S&P (black circles) against the theoretical quantiles (red line), defined here by a random distribution. If the S&P’s daily returns were perfectly random, the black circles would match the red line.

Normal distributions are still useful for analyzing markets and designing portfolios. Indeed, even in the daily return plot above it’s clear that the distribution looks quite normal for a fair amount of the sample. We can’t rely on normality alone for modeling markets. Factoring in fat-tails risk is essential. But letting a fat-tail worldview dominate your analysis is every bit as flawed as assuming that normal distributions will prevail. Asset pricing doesn’t neatly fit into one theoretical box, which means that our analytical tool kit shouldn’t be in a conceptual straightjacket either.