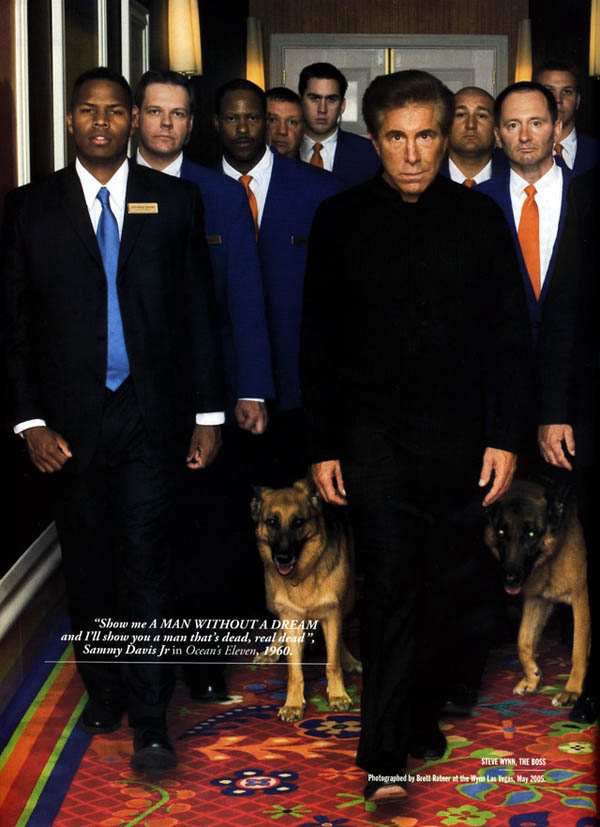

Wynn turned around again. He put his pinkie in the hole and observed that a flap of canvas had been pushed back. He told his guests, “Well, I’m glad I did it and not you.” He said that he’d have to call Cohen and William Acquavella, his dealer in New York, to tell them that the deal was off. Then he resumed talking about his paintings, almost, but not quite, as though he hadn’t just delivered what one of the guests would later call, in an impromptu stab at actuarial math, a “forty-million-dollar elbow.”

A few hours later, they all met for dinner, and Wynn was in a cheerful mood. “My feeling was, It’s a picture, it’s my picture, we’ll fix it. Nobody got sick or died. It’s a picture. It took Picasso five hours to paint it.” Mary Boies ordered a six-litre bottle of Bordeaux, and when it was empty she had everyone sign the label, to commemorate the calamitous afternoon. Wynn signed it “Mary, it’s all about scale—Steve.” Everyone had agreed to take what one participant called a “vow of silence.”

And a similar story on fixing a Monet on Hyperallergic.