Frédéric Filloux :

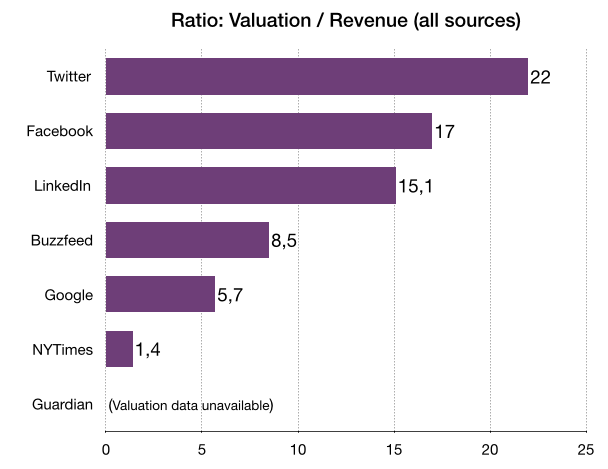

Through this lens, if Wall Street could assign to The New York Times the ratio Silicon Valley grants BuzzFeed (8.5 instead of a paltry 1.4), the Times would be worth about $19bn instead of the current $2.2bn.

Again, there is no doubt that Wall Street would respond enthusiastically to a major shrinkage of NYTCo’s print operations; but regardless of the drag caused by the newspaper itself, the valuation gap is absurdly wide when considering that 75% of BuzzFeed traffic is actually controlled by Facebook, certainly not the most reliably unselfish partner.

While BuzzFeed relies on ridiculous headlines and traffic from Facebook, investors are more inclined to value BuzzFeed way higher than the Times because of the potential it can generate in the future.

On the other hand, the Times is a safe-house, which proved to be realistic 5-7 years ago by transitioning into a successful digital brand. So all in all, the growth of Times is less tangible than a relatively new website. That’s precisely why there’s such a gap between the two. Though to be perfectly realistic, considering that one is kinda overvalued and the other one undervalued (in Silicon Valley standard) these two ratios should adjust and get closer together.