Physics, properly understood, is not a subject taught at schools and university departments; it is a certain way of understanding how processes happen in the world. When Aristotle wrote his Physics in the fourth century B.C., he wasn’t describing an academic discipline, but a mode of philosophy: a way of thinking about nature. You might imagine that’s just an archaic usage, but it’s not. When physicists speak today (as they often do) about the “physics” of the problem, they mean something close to what Aristotle meant: neither a bare mathematical formalism nor a mere narrative, but a way of deriving process from fundamental principles.

Author: Edouard Chazal

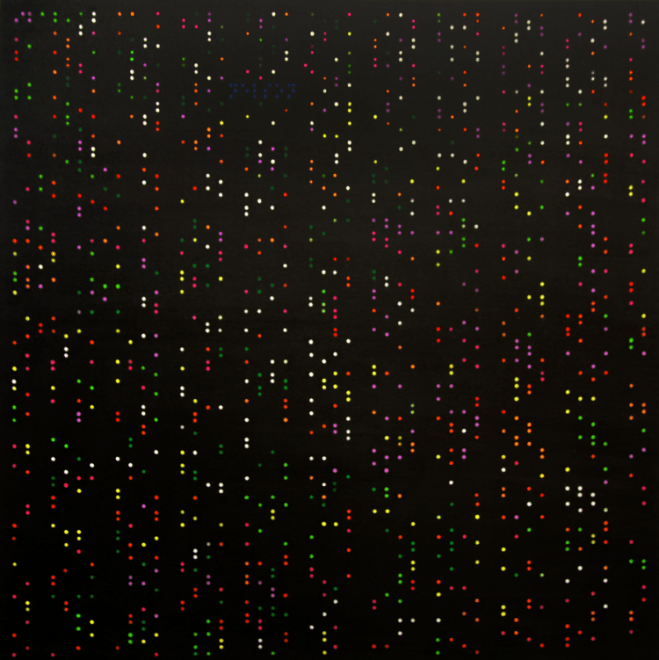

The Warhol of Wall Street

We’re Not in Kansas Anymore is about the 2008 financial crisis that kicked off with the implosion of investment bank Lehman Brothers (for the record, Mr. Saiers thinks the government should have bailed them out). Braille-like lettering symbolizes the systemic blindness that created the crisis, he says—blindness of regulators to the realities of modern finance, blindness of ratings agencies to the real risks of pooled mortgage-backed securities—while circles and squares represent the problem of predicting how financial markets will behave. They reference the classic problem known as “squaring the circle,” which is the idea that you could make a square with the same area as a given circle. It is impossible, but you can get very close, Mr. Saiers explained—just as it’s impossible to anticipate financial markets, though you can make very smart guesses.

The Rise Of Autism

A recent study in JAMAPaediatrics, a science journal, calculated that the lifetime cost of supporting an American with autism was $1.4m-2.4m. Paul Leigh of the University of California at Davis and Juan Du of Old Dominion University have added up not only the cost of care but also the opportunity costs of autism in America. They include an estimate of the output lost when autistic people are jobless or underemployed, and when their relatives cut back on working hours to look after them. They put the total at $162 billion-367 billion in 2015, the equivalent of 0.9-2% of GDP, on a par with both diabetes and strokes. By 2025 the figure could exceed $1 trillion, they predict. Confronting autism is costly, but failing to do so may cost even more.

Who Funds the Future?

“The biggest outcomes come when you break your previous mental model. The black-swan events of the past forty years—the PC, the router, the Internet, the iPhone—nobody had theses around those. So what’s useful to us is having Dumbo ears.” A great V.C. keeps his ears pricked for a disturbing story with the elements of a fairy tale. This tale begins in another age (which happens to be the future), and features a lowborn hero who knows a secret from his hardscrabble experience. The hero encounters royalty (the V.C.s) who test him, and he harnesses magic (technology) to prevail. The tale ends in heaping treasure chests for all, borne home on the unicorn’s back.

The Secret Six

“The FX was definitely ahead of its time for having a semi-automatic gearbox,” says Kim.

“The Sultan and his brother really were R&D for many high-end automakers. They were building custom bespoke cars that not only had unique bodies and interiors, but sometimes exotic technologies. And the money was limitless.”