No less than the second in command of China, the Premier Li Keqiang, has stated that Chinese GDP data is unreliable and “man-made”. To put this in perspective, the current Premier of China, second in command for the entire country, leading economic policy formulation, a Phd in economics, having spent essentially all his career inside public administration in various posts throughout China advises you not to trust GDP figures or the economics professor in the United States who has never lived in China and has no specific expertise in China.

Category: Economics

China Blames a Different Boogeyman Each Time the Economy Stumbles

In a humiliating televised confession, Wang acknowledged that “I acquired the news from private conversations, which is an abnormal way, and added my personal judgment and subjective views to finish this story” (which, you know, is how journalism usually works). In the United States when someone accurately predicts a downturn or policy change, we practically throw him a ticker-tape parade; in China, they throw him in jail.

Blaming China for Black Monday is Like Blaming a Bartender For Your Hangover

What is happening? Why is China—the country that people once thought was the engine of the world economy—tottering so badly ?

To answer these questions it is necessary to recognize that China was never the engine of the world’s growth. To be such an engine you have to import more than you export. Then you would create a demand that is filled by other countries, which as a result export more than they import. Importers are the engines in the supply trains of the international markets. Exporters are the wagons, pulled by the demand created by the profligates. Think of what drives liquor markets: barmen or drinkers?

Credit: Michael Lomax, Impossible Bottle

Black Monday, Kinda

Monday, August 24th brought you one of the weirdest trading day ever seen in the past several years.

So to sum up what happened today, here are a few charts, courtesy of Bloomberg, ZeroHedge and NANEX — time of the events may vary :

- It all started sometimes in China, when it’s business as usual these days :

- S&P Futures followed, kissing the dirt :

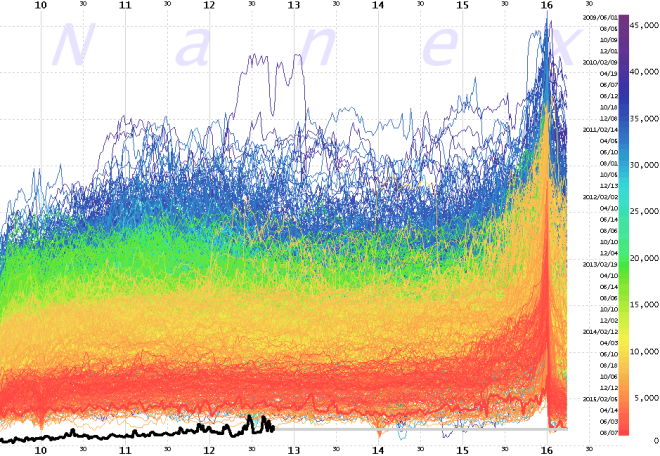

- Which then started a major liquidity squeeze on the US market, as seen on the following charts by NANEX :

- Causing buy-sell orders to never quiet match — courtesy of ZeroHedge :

- Shortly after the opening bell, something like this on the Dow Jones :

- And an impressive rise on the VIX :

- In the meantime, major (mini) crashes :

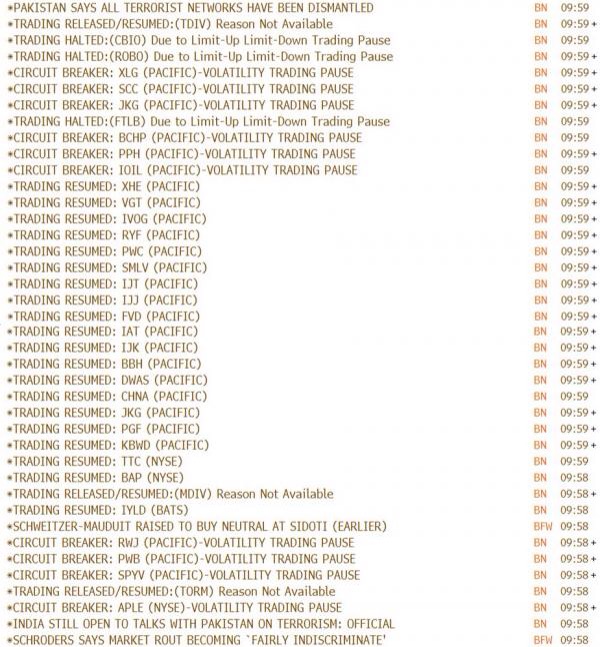

- To prevent further deterioration, just press the “HALT” button across major indices, including 3 consecutive press on the NASDAQ and 1’200 times during that day :

- Then the master of markets, Tim Cook, dropped an email to Jim Cramer stating the following :

I get updates on our performance in China every day, including this morning, and I can tell you that we have continued to experience strong growth for our business in China through July and August. Growth in iPhone activations has actually accelerated over the past few weeks, and we have had the best performance of the year for the App Store in China during the last 2 weeks.

- Which caused this :

- Then, all of a sudden, while unrelated from the previous event — well, who knows :

- Oups…

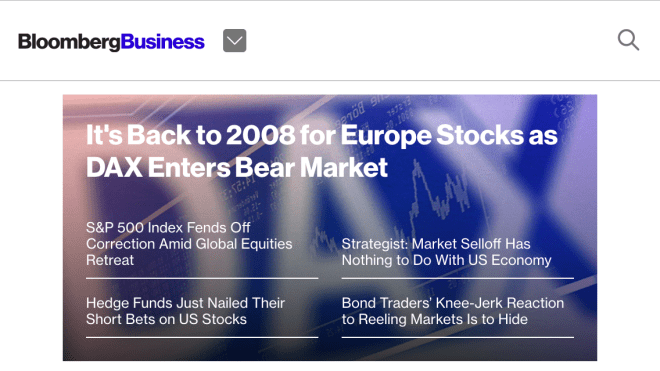

- …While European markets will stay stucked for a little longer :

There’s more to it for sure, but here are some events, mostly correlated, to show the newcomer what’s up for today on the trading side.

Finally here’s a fun tweet from Josh Brown :

@ReformedBroker: Look, it doesn’t matter what you bought or what you sold. The important thing is that you panicked.

Mastering the Machine

“In any given market, Bridgewater may have a dozen or more different indicators. However, even when most or all of the indicators are pointing in a certain direction, Dalio doesn’t rely solely on software. Unless he and Jensen and Prince agree that a certain trade makes sense, the firm doesn’t make it. While this inevitably introduces an element of human judgment to the investment process, Dalio insists it is still driven by the rules-based framework he has built up over thirty years. “When I’m thinking, ‘What is going on today?,’ I also need to make the connection to ‘How does what is happening today fit into our framework for making this decision?’ ’’ he said. Ultimately, he says, it is the commitment to systematic analysis and systematic investment that distinguishes Bridgewater from other hedge funds. “I hear a lot of people describing what’s happening today without the proper historical context and without the framework of how the machine works,” he says.”

The New York Magazine on the culture of Bridgewater :

The path to Principles began early in Bridgewater’s history, when Dalio began to think that employees, like economies, could be understood as following patterns. Transcendental Meditation informed his belief that a person’s main obstacle to improvement was his own fragile ego; at his firm, he would make constant, unvarnished criticism the norm, until critiques weren’t taken personally and no one held back a good idea for fear of being wrong. Dalio’s chosen investment system depended on such behavior. Unlike at a hedge fund such as Steven Cohen’s SAC Capital, where star traders are given chunks of the firm’s capital to run quasi-independent desks (and offset each other’s losses), everyone at Bridgewater essentially contributes to the same strategy as they work under Dalio and his longtime confidants and co-CIOs Bob Prince and Greg Jensen. Dalio thought radical transparency could optimize the hive mind. “The culture makes you have to listen to other people,” says Giselle Wagner, a former Bridgewater chief operating officer.